Steps to Secure a Job in Venture Capital: A Comprehensive Guide

Introduction

Venture capital firms have become integral players in the startup ecosystem, providing essential funding and guidance to early-stage companies poised for significant growth. As the venture capital landscape has evolved dramatically over the past decade and a half, the roles within these firms have also transformed. With venture assets under management soaring from $300 billion to an astounding $3.5 trillion since 2008, the number of active VC funds has expanded more than threefold.

This article delves into the multifaceted roles within venture capital firms, the essential skills required to excel as a venture capitalist, and the strategic steps to break into this competitive field. By understanding the intricate dynamics and preparing for the challenges, aspiring candidates can position themselves to thrive and make a meaningful impact in the venture capital industry.

Understanding Venture Capital Firms and Roles

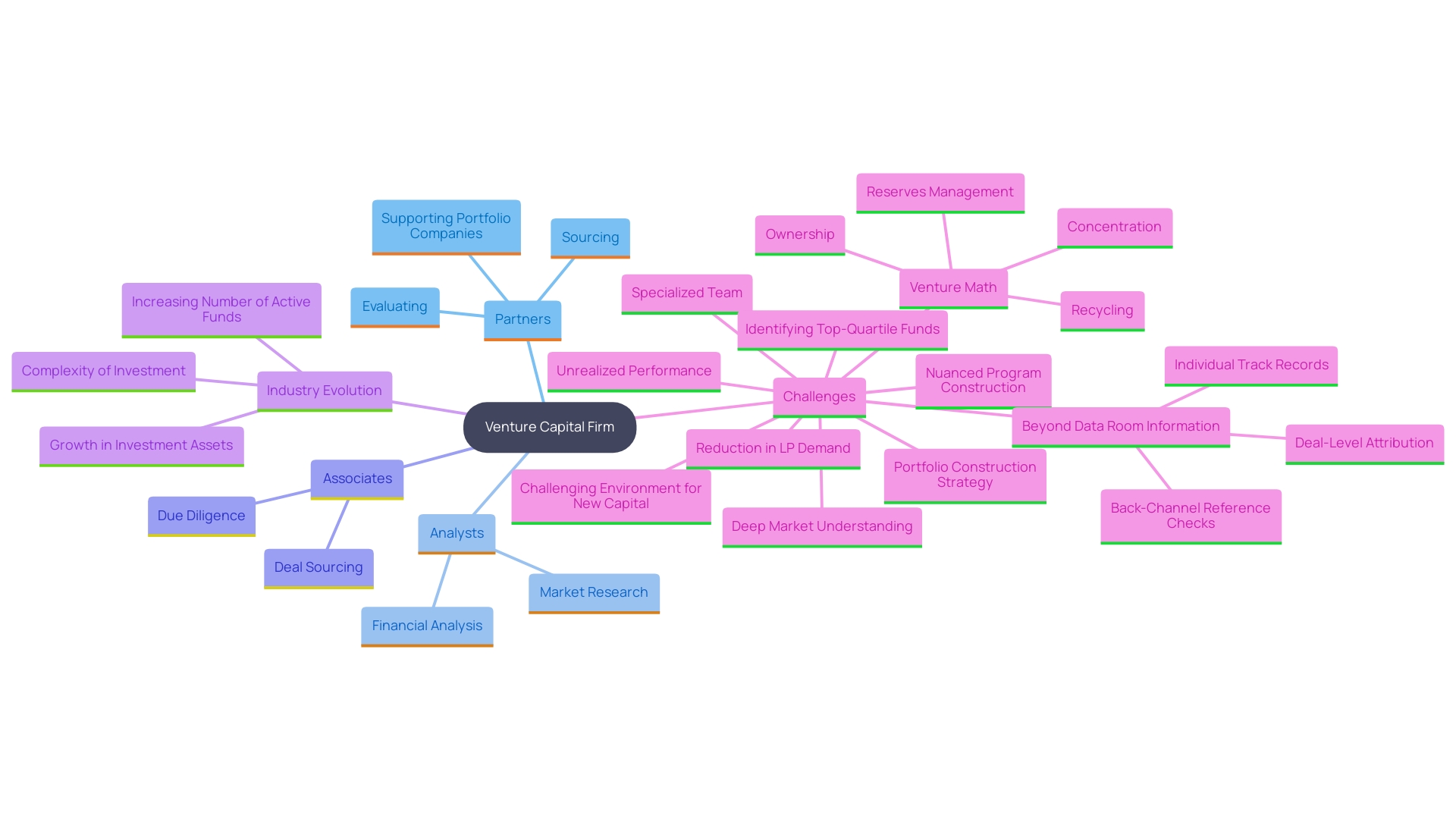

Venture capital (VC) firms are a keystone in the startup ecosystem, offering critical funding and expertise to early-stage companies with high growth potential. The structure of these firms typically includes partners who make pivotal investment decisions, analysts who conduct in-depth market research, and associates who support due diligence and portfolio management. This composition has evolved significantly over the past 15 years, driven by the impressive growth and maturation of the industry. Since 2008, investment assets under management have skyrocketed from $300 billion to $3.5 trillion, and the number of active capital funds has increased more than 3.5 times, reflecting the sector’s expansion.

The role of an investment backer is multifaceted, blending art and science to excel in sourcing, evaluating, winning, and impacting portfolio companies. Sourcing involves identifying the right opportunities and maintaining a robust network, while judging opportunities requires a keen understanding of exceptional founders and large markets. Securing competitive agreements requires providing distinctive value propositions beyond merely financial resources, and effectively aiding founders after investment is essential.

Real-world data underscores this complexity. A strong investment initiative today necessitates a large, specialized group skilled in conducting thorough due diligence, including back-channel reference checks and utilizing extensive networks to evaluate deal-level attribution and individual track records. This meticulous process emphasizes why manager selection is so vital for success in investment.

Ultimately, grasping the complex dynamics and roles within a VC firm can enable aspiring candidates to recognize the right opportunities and customize their applications, positioning themselves to contribute significantly to the changing investment landscape.

Essential Skills for Venture Capitalists

To excel in venture capital, candidates must master a distinctive combination of skills. Robust financial knowledge and sharp analytical skills are fundamental to assessing investment opportunities accurately. Business acumen further aids in understanding market dynamics and potential returns. Networking and relationship-building abilities are indispensable, enabling VCs to forge connections with entrepreneurs, industry experts, and potential Limited Partners (LPs). The success of Birdies, a company born from Bianca Gates’ frustration with unappealing house slippers, exemplifies how strong relationships can foster innovative ideas and prosperous projects.

Strategic thinking and problem-solving are critical for navigating the complexities of high-risk investments. As the investment landscape evolves, with early-stage funding trending up by 10% and late-stage funding down by 20%, investors must adapt swiftly to these shifts. The ability to source, judge, win, and impact portfolio companies is essential. Successful VCs know which networks to tap into and how to offer value beyond financial backing, often providing strategic advice and leveraging their extensive networks.

Moreover, grasping the financial aspects of investment funding, encompassing concentration, ownership, reserves management, and recycling, is essential. Managers who skillfully construct portfolios and execute disciplined strategies are more likely to achieve top-quartile returns. This nuanced approach has become more crucial as the investment industry has expanded from $300 billion to $3.5 trillion in assets under management since 2008. With fewer resources available and heightened competition, VCs must showcase a clear value proposition to attract and retain top-tier funding.

In this challenging environment, continuous learning and adaptation are key. Programs like the LP Institute, which teach the process of investing in leading capital managers, highlight the importance of ongoing education and practical application. As James Currier pointed out, the program’s practical approach guarantees that participants not only learn theoretical aspects but also implement this knowledge in real projects, nurturing a new generation of proficient venture capitalists.

Steps to Get into Venture Capital

-

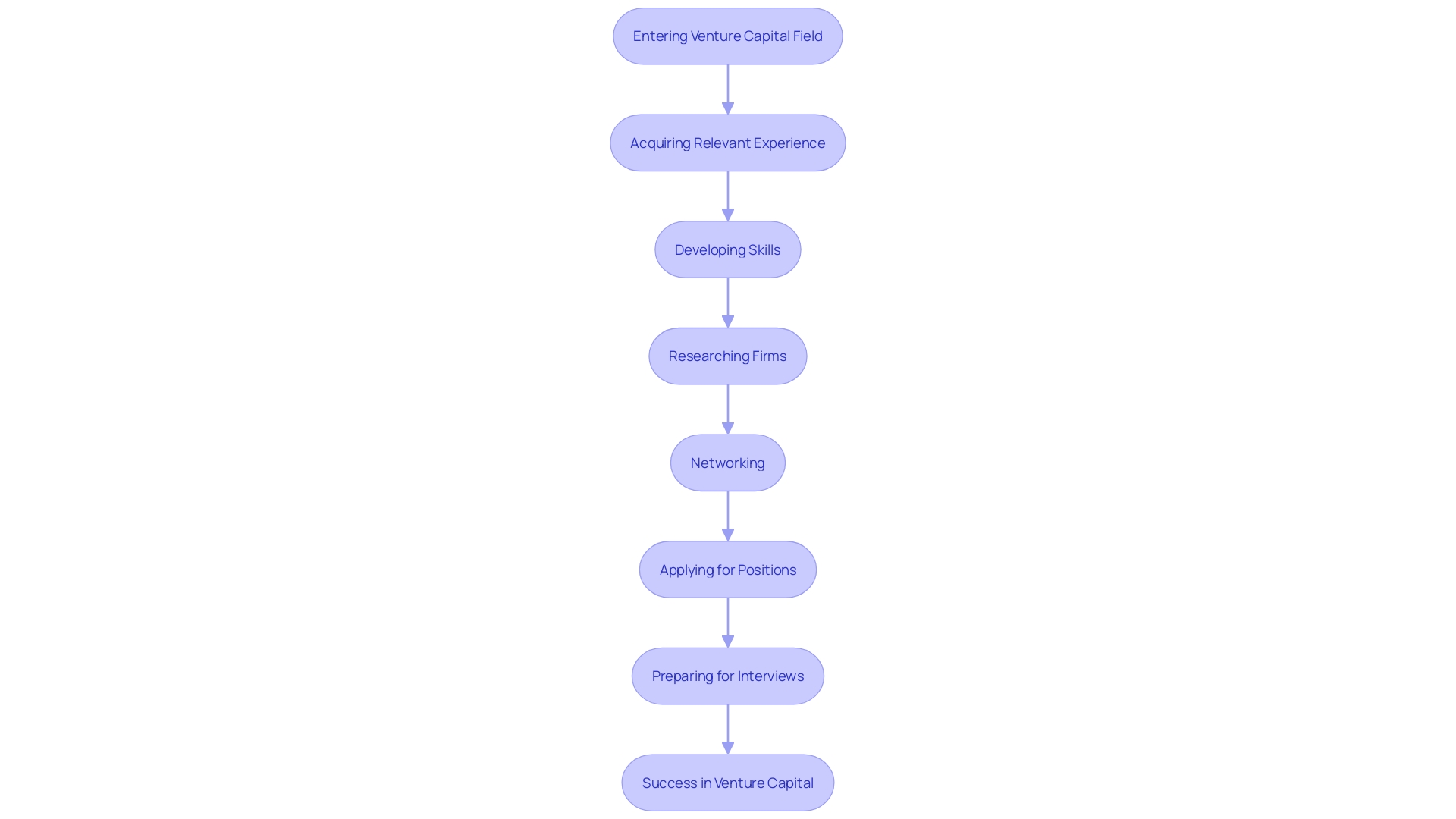

Acquire Relevant Experience: Engage in areas such as banking, private equity, or consulting to build a strong base in financial analysis and business strategy. These areas provide invaluable insights that will be essential for assessing startups and making informed choices. Understanding the incentive structures behind venture capital, as highlighted by industry experts, can also provide a significant edge.

-

Develop Your Abilities and Understanding: Remain in front of the competition by consistently learning about market trends, startup environments, and funding strategies. Engage with comprehensive resources such as Tomasz Tunguz’s and StrictlyVC newsletters, which are essential reads for over 140,000 members in the VC and entrepreneurial communities. These newsletters cover a wide array of practical advice, from business models and innovation to startup metrics, helping you align your strategies with current market conditions.

-

Research Venture Capital Firms: Identify firms that resonate with your interests and values, particularly those investing in sectors you are passionate about. A deep understanding of a firm’s investment thesis and existing portfolio can be crucial during interviews. As Ladi Greenstreet from Natwest suggests, developing and pitching a well-researched thesis about the next big thing can set you apart from other candidates.

-

Network with Venture Capitalists: Attend sector events, seminars, and conferences to build connections with seasoned professionals. Networking is not just about meeting people; it’s about gaining insights into the VC world. According to Grim, a key differentiator for VC candidates is their ability to engage with and understand entrepreneurs, making networking an essential step.

-

Apply to Job Postings and Consider Internships: Actively search for entry-level positions or internships at VC firms to gain firsthand experience. Understand that the process of landing a role in VC can take up to 6-9 months, so plan accordingly. This timeline underscores the importance of persistence and strategic planning in your job search.

-

Develop a Strong Resume and Prepare for Interviews: Highlight your relevant experience, skills, and passion for the industry. Practice typical interview questions and be ready to discuss firms you are interested in, write financial memos, and evaluate portfolio companies. Demonstrating your preparedness and enthusiasm can make a lasting impression on potential employers.

Challenges and Considerations in Venture Capital Careers

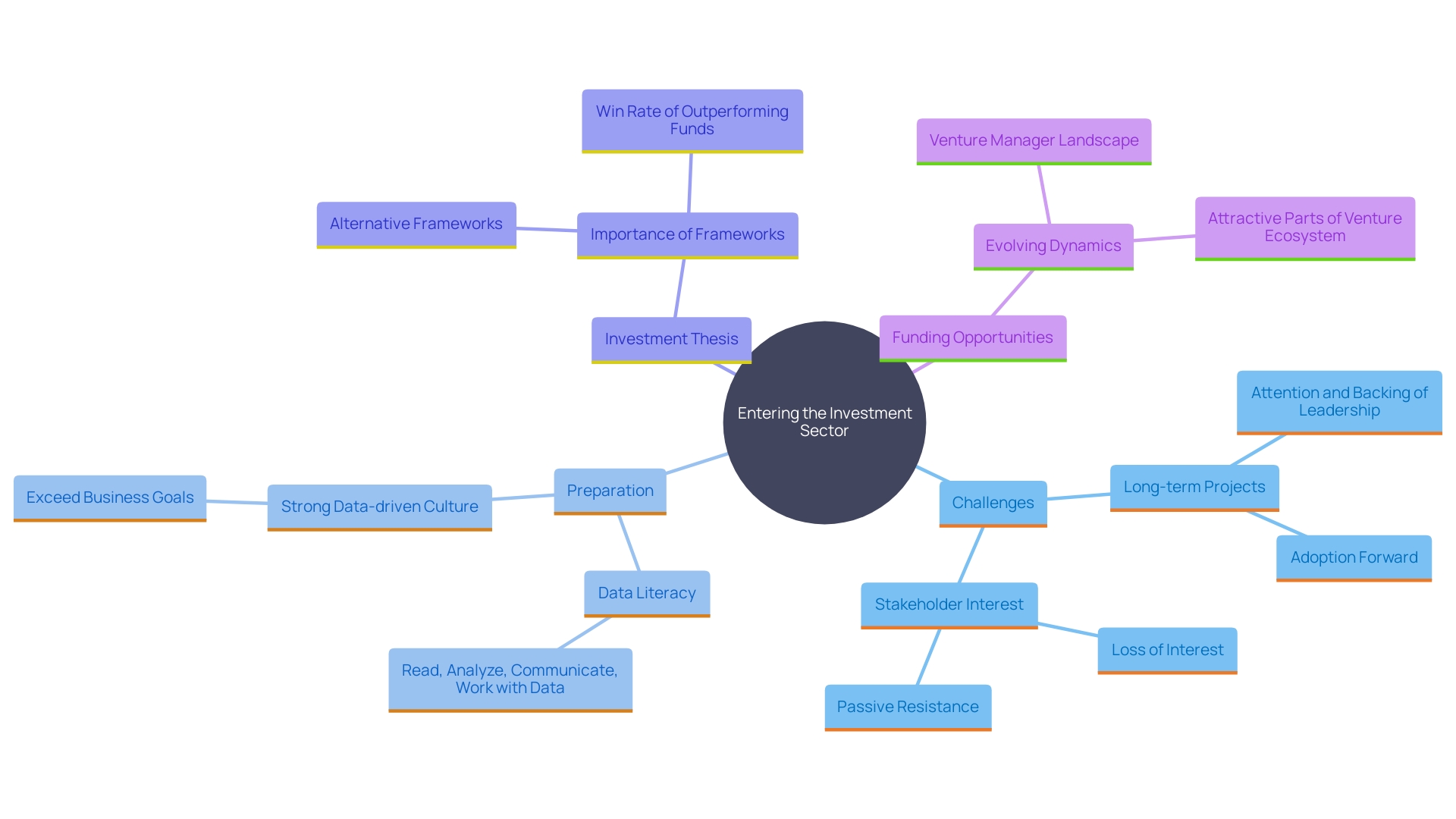

Entering the investment sector can be a challenging and competitive experience. Limited job openings and a strong professional network requirement are just the beginning. Accepting the high-risk aspect of startup financing is essential, as not every endeavor will produce favorable results. This calls for resilience and a readiness to learn from setbacks.

Preparation is key. Dive into the realm of investment funding – grasp how it functions, what financiers look for at various phases, and examine firms that are developing, acquiring resources, expanding, and departing. As Kristina Simmons wisely advises, “Be yourself. Especially to be an investor, you have to be contrarian or different to be great. Don’t try to be a shark, when you’d rather be a dolphin.”

Developing and pitching a strong investment thesis can set you apart. Ladi Greenstreet from Natwest suggests writing down your thesis, collecting evidence, and proving its validity. This evidence-based conviction could be your ticket to a venture capital job.

Furthermore, the sector dynamics are evolving. As fundraising slows, opportunities at the earliest stages are shifting. Seed funding appears flat, but early-stage funding is up by about 10%, providing a window of opportunity. Despite these challenges, the talent pool is richer. The downturn has unlocked talent, offering startups the chance to build world-class teams.

Understanding these dynamics and preparing for them can significantly enhance your chances of success in this dynamic field. Immerse yourself in learning, stand out by being uniquely you, and seize the opportunities that arise from industry shifts.

Conclusion

The venture capital landscape is a vibrant and evolving sphere, underscoring the critical role that venture capital firms play in nurturing innovative startups. By understanding the various roles within these firms and the essential skills needed to thrive, aspiring venture capitalists can effectively navigate this competitive environment. The impressive growth of venture capital assets and the increasing number of active funds reflect the immense opportunities available for those equipped with the right knowledge and expertise.

Mastering the unique blend of analytical skills, strategic thinking, and relationship-building is vital for success in the venture capital field. As the industry continues to adapt to changing market dynamics, staying informed and agile is paramount. Continuous learning and networking will empower candidates to make informed decisions, build valuable connections, and ultimately contribute to the success of startups and the venture capital firms that support them.

Breaking into venture capital may be challenging, but the potential rewards are substantial. By gaining relevant experience, developing a strong investment thesis, and embracing the high-risk nature of the industry, candidates can position themselves for success. The current landscape presents opportunities for those willing to learn, adapt, and innovate.

Embracing these challenges and seizing opportunities can lead to a fulfilling and impactful career in venture capital, where the possibilities for growth and success are boundless.